Handing over the car keys to your teenager is a proud moment, but it comes with a reality check: young drivers have the highest accident rates on the road, simply because they’re new to driving. For families, this can lead to insurance premiums that soar, along with a surge in liability risk. That’s why an umbrella policy isn’t just a luxury—it’s a smart safety net that protects your family’s finances and brings peace of mind as your teen gains confidence behind the wheel.

How Much More Expensive is it for Young Drivers?

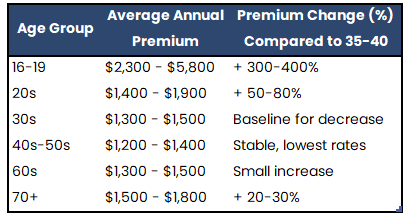

The cost of insuring a teen driver can be staggering, with premiums often reaching 300-400% higher than those for middle-aged drivers (Policygenius). For families, this steep increase isn’t just a financial burden; it highlights the increased liability risks that make an umbrella policy a smart safety net.

To illustrate these trends, data from industry sources shows that while drivers in their 20s see a modest reduction, middle-aged drivers—those in their 40s and 50s—enjoy the lowest premiums due to their experience and lower accident rates (Compare.com, Capital One).

Why is Car Insurance More Expensive for Young Drivers?

Adding a young driver to your insurance policy can often result in sticker shock. Here’s why:

- Lack of Experience: Teens are still developing their driving skills and are more prone to making errors in judgment. Without years of practice, they’re less adept at handling complex situations, which raises their likelihood of accidents.

- Higher Risk of Accidents: Statistically, teens have the highest accident rates per mile driven. The Insurance Institute for Highway Safety reports that drivers aged 16 to 19 are four times more likely to be in an accident than older drivers (ValuePenguin).

- Riskier Driving Behaviors: Teens are more likely to engage in high-risk behaviors, like speeding, distracted driving (especially with mobile phones), and not wearing seat belts. These behaviors directly increase the risk of severe accidents.

- Increased Fatality Rates: According to studies, teen accidents are more likely to result in serious injuries or fatalities, which leads to costly claims for insurers (Capital One).

- Lack of Familiarity with Defensive Driving: Teens may lack the foresight and habits of defensive driving, such as anticipating other drivers’ actions or adjusting for poor weather. Without these instincts, they are more vulnerable to accidents.

These factors combined make insuring a young driver costly, but taking steps like promoting safe driving habits can help manage risks and keep costs down.

The Importance of an Umbrella Policy: Added Protection for Your Family

Adding a teen driver to your policy dramatically increases both the cost and the risk exposure for your family. With accident rates highest among teen drivers, the potential liability in even a single accident can far exceed standard coverage limits. That’s where an umbrella policy becomes essential. This extra layer of protection steps in when traditional auto insurance maxes out, covering high-cost claims for injuries, property damage, and legal expenses. For a family, an umbrella policy isn’t just additional insurance—it’s a shield that safeguards your financial future, ensuring peace of mind as your teen gains experience on the road.

An umbrella policy can help protect your family financially in case of an accident involving your young driver. Here’s how:

- Enhanced Liability Coverage: Umbrella policies add an extra layer of liability coverage beyond your auto and homeowners policies, helping cover medical or legal expenses if your young driver is found responsible for an accident.

- Protection Against Lawsuits: In severe accidents, injury claims may exceed standard auto policy limits, leaving families financially exposed. An umbrella policy can cover the gap, safeguarding family assets.

- Peace of Mind: Knowing your family has added protection against financial loss provides peace of mind, especially as your young driver gains experience on the road.

Tips for Adding Youthful Drivers to Your Policy

If you’re preparing to add a youthful driver to your auto policy, here are some essential tips to keep in mind:

- Increase Your Liability Limits to 250/500/100: When you add a youthful driver, it’s crucial to increase your liability limits to $250,000/$500,000 for bodily injury and $100,000 for property damage. This coverage ensures that your family is protected against higher costs in the event of an accident.

- Requote Your Auto Policy: The moment you bring them onto your policy, it’s worth getting a fresh quote to see if a different insurer offers a better rate. Certain companies handle youthful drivers’ rates more favorably than others.

- Let Nightlight Help You Navigate the Market: With so many companies offering different rates for youthful drivers, there’s no one better to guide you than our experienced team at Nightlight Insurance Agency. We know the ins and outs of the market and can help you find the best coverage and rates to fit your family’s needs.

Conclusion

Families with youthful drivers face unique risks due to the likelihood of accidents, which can bring unexpected costs and legal consequences. During this stage—when financial vulnerability is often highest—an umbrella policy is an invaluable asset to help protect against significant financial strain.

At Nightlight Insurance Agency, we’re dedicated to helping families find peace of mind through every life stage, especially with youthful drivers in the mix. Contact us today to discuss how we can help you safeguard your future. Let us illuminate your coverage options and guide you

toward greater financial security.